ct sales tax exemptions

12-41289 for sales and purchases of machinery equipment tools materials supplies and fuel used directly in the biotechnology. Filing Season - DRS asks that you strongly consider filing your Connecticut individual income tax return electronically.

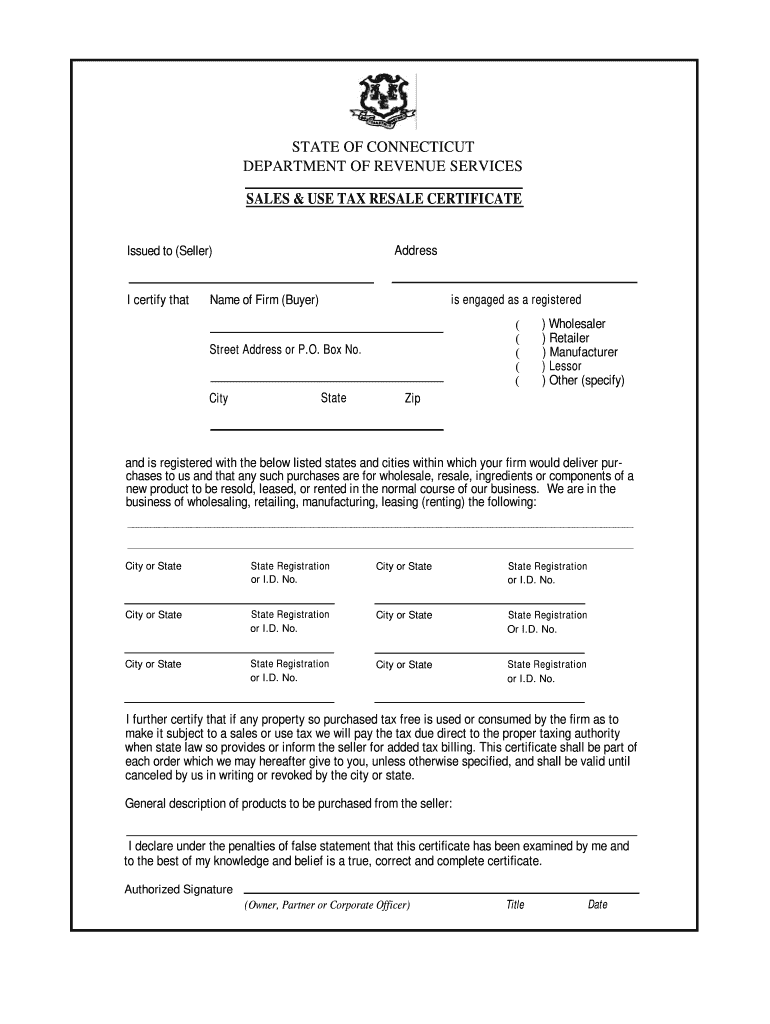

Ct Sales Use Tax Resale Cerfiticate Us Legal Forms

It imposes a 635 tax with some exceptions on the retail sales of tangible personal property purchased 1 in Connecticut ie sales tax or 2 outside Connecticut for use here ie use tax.

. Electronic filing is free simple secure and accessible from the comfort of your own home. In Connecticut drop shipments are generally exempt from sales taxes. Exemptions from Sales and Use Taxes.

FilmTVDigital Media Tax Exemptions Find out more about the available tax exemptions on film video and broadcast productions in Connecticut. Download Or Email OS-114 More Fillable Forms Register and Subscribe Now. The DRS imposes a good faith requirement on this type of.

The individual identified as the drop shipper is required to collect tax only if the customer is not considered to be engaged in business in Connecticut. In Connecticut certain items may be exempt from the sales tax to all consumers not just tax-exempt purchasers. This estimate is based on summaries of this data provided in the DRS Annual Reports for 2007-08.

CT Sales Use Taxes. According to the most recently published IRS statistics March 2002 10696 organizations in Connecticut were recognized as tax-exempt in 2001 and therefore eligible for sales tax exemptions. Electronic filing is free simple secure and.

UConns Sales Tax Exemption Letter from the CT Department of Revenue Services. Sales of Food and Beverages at Schools and Care Facilities Exempt from CT sales tax. Purchases of Meals or Lodging by Tax Exempt Entities.

Gas Tax - For detailed information on the Suspension of the Motor Fuels Tax click here. Seller should obtain a CT resale certificate. We are awaiting the number of such organizations that were eligible for exemptions in an earlier year and will forward it to you when we receive it from.

Filing Season - DRS asks that you strongly consider filing your Connecticut individual income tax return electronically. This Policy Statement describes the exemption under Conn. This page discusses various sales tax exemptions in Connecticut.

While the Connecticut sales tax of 635 applies to most transactions there are certain items that may be exempt from taxation. Manufacturing and Biotech Sales and Use Tax Exemption See if your manufacturing or biotech company is. To avoid double taxation a sale made for resale is not subject to sales tax.

It is the sellers responsibility to keep this certificate as proof of tax-exempt status. A farm vehicle is exempt from the 635 percent sales tax rate if you use it for agricultural production per Connecticuts DMV. Because Connecticut is a member of this agreement buyers can use the Multistate Tax Commission MTC Uniform Sales Tax Certificate when making qualifying sales-tax-exempt.

As with all Sales Use Tax research the specifics of each case need to be considered when determining taxability. Counties and cities are not allowed to collect local sales taxes. Groceries prescription drugs and non-prescription drugs are exempt from the Connecticut sales tax.

The Connecticut state sales tax rate is 635 and the average CT sales tax after local surtaxes is 635. The Department of Revenue Services DRS collects data on this tax exemption claim through the Sales and Use Tax Return form. Connecticut law provides for an exemption from Connecticut sales and use taxes for qualifying nonprofit organizations.

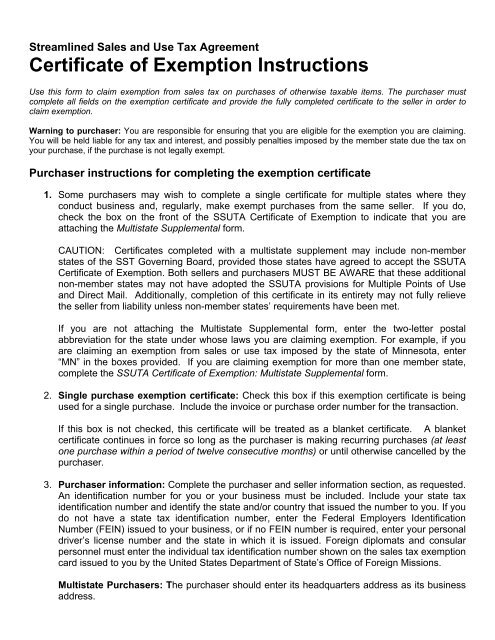

Services of self-employed welder exempt from sales tax. Complete Edit or Print Tax Forms Instantly. Connecticut is a member of the Streamlined Sales and Use Tax Agreement an interstate consortium with the goal of making compliance with sales taxes as simple as possible in member states.

Structure of Sales Tax Law Nontaxable Exempt sales Resales. SalesTaxHandbook has an additional five Connecticut sales tax certificates that you may need. The following is a list of items that are exempt from Connecticut sales and use taxes.

Agile Consulting Groups sales tax consultants can be found on our page summarizing Connecticut sales and use tax exemptionsIf you have questions comments or would like to discuss the specific circumstances you are encountering in regard. 44 rows Sales and Use Tax Exemption for Purchases Made Under the Buy Connecticut. Fill out and give a Farmers Tax Exemption Permit to.

The state imposes sales and use taxes on retail sales of tangible personal property and services. This is not a complete list of exemptions but it does include purchases commonly made by individual consumers. For other Connecticut sales tax exemption certificates go here.

April 2022 Connecticut Sales and Use TaxFree Week - For detailed information on the Sales and Use Tax-Free Week click here. Sales Tax Exemptions in Connecticut. Such retailers are supposed to submit resale exemption certificates to the sellers.

CT Sales Tax. Machinery Component Parts and Replacement and Repair Parts of Machinery Used Directly in a. Sales tax to be collected if at all at time of original transfer.

Retailers purchasing goods for resale are not subject to Connecticuts sales tax. Connecticut has a statewide sales tax rate of 635 which has been in place since 1947. Municipal governments in Connecticut are also allowed to collect a local-option sales tax that ranges from 0 to 0 across the state with an average local tax of NA for a total of 635 when combined with the state sales tax.

Ad Access Tax Forms. For a complete list of exemptions from Connecticut sales taxes refer to Conn. An organization that was issued a federal Determination Letter of exemption under Section 50lc3 or 13 of the Internal Revenue Code is a qualifying organization for the purposes of the exemption from sales and use taxes.

April 2022 Connecticut Sales and Use TaxFree Week - For detailed information on the Sales and Use Tax-Free Week click here. Exemption from Sales and Use Taxes for Items Used Directly in the Biotechnology Industry This publication has been cited in IP 201725 PURPOSE.

Exemptions From The Connecticut Sales Tax

How To Get A Sales Tax Exemption Certificate In Colorado Startingyourbusiness Com

Sales And Use Tax Regulations Article 3

How To Get A Sales Tax Exemption Certificate In Wisconsin Startingyourbusiness Com

Map State Sales Taxes And Clothing Exemptions Trip Planning Sales Tax Map

Sales And Use Tax Regulations Article 3

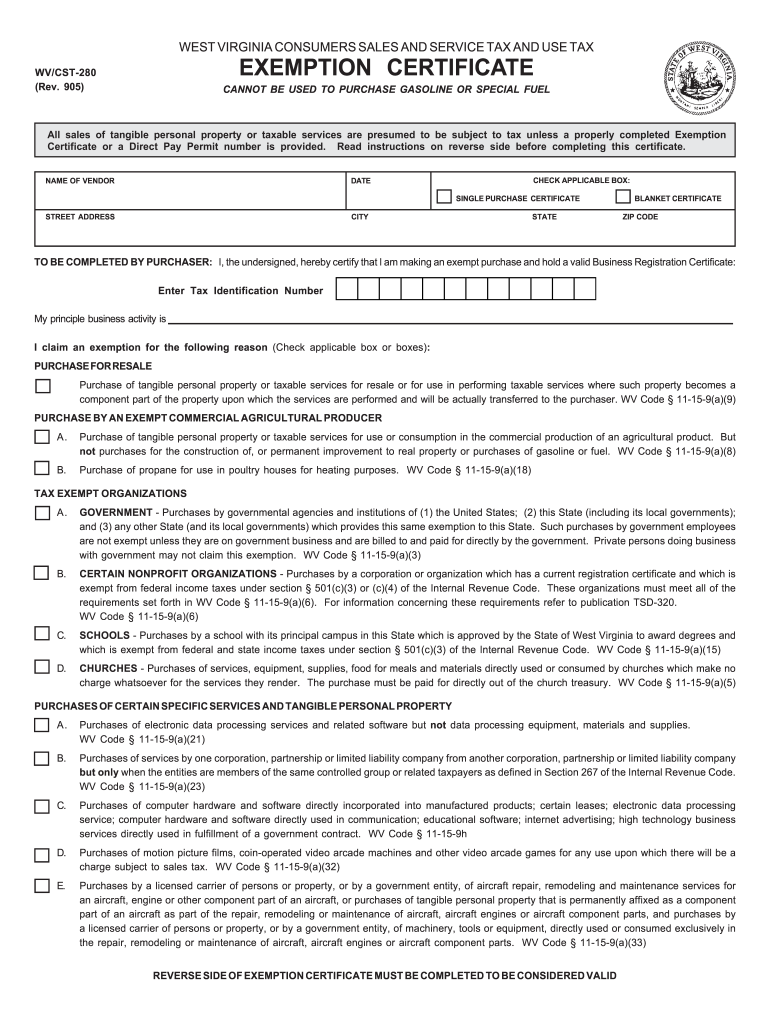

Wv Tax Exempt Form 2021 Fill Online Printable Fillable Blank Pdffiller

Oklahoma Tax Exempt Form Fill Online Printable Fillable Blank Pdffiller

How To Get A Sales Tax Exemption Certificate In Ohio Startingyourbusiness Com

How To Get A Sales Tax Exemption Certificate In Missouri Startingyourbusiness Com

Sales And Use Tax Regulations Article 3

How To Get A Sales Tax Exemption Certificate In Indiana Startingyourbusiness Com

Certificate Of Exemption Instructions

Solar Property Tax Exemptions Explained Energysage

Map Of The Top 5 Highest And Lowest Median Property Tax Payments In America Find This Image On Blog Phmc Com Property Tax Tax Payment Mortgage Payment

Tax Exempt Sales Use And Lodging Certification Standardized As Of Jan 1 2016 Alabama Retail Association

Sales Tax Exemptions Finance And Treasury

Sales Tax Exemption For Building Materials Used In State Construction Projects